Climate change is believed to contribute to an increase in both the frequency and severity of extreme weather events, with emerging markets bearing the brunt of many severe losses. This, in turn, exacerbates the property protection gaps in these regions. Building resilience against natural calamities will remain a high priority for emerging markets.

Climate change: A reality check

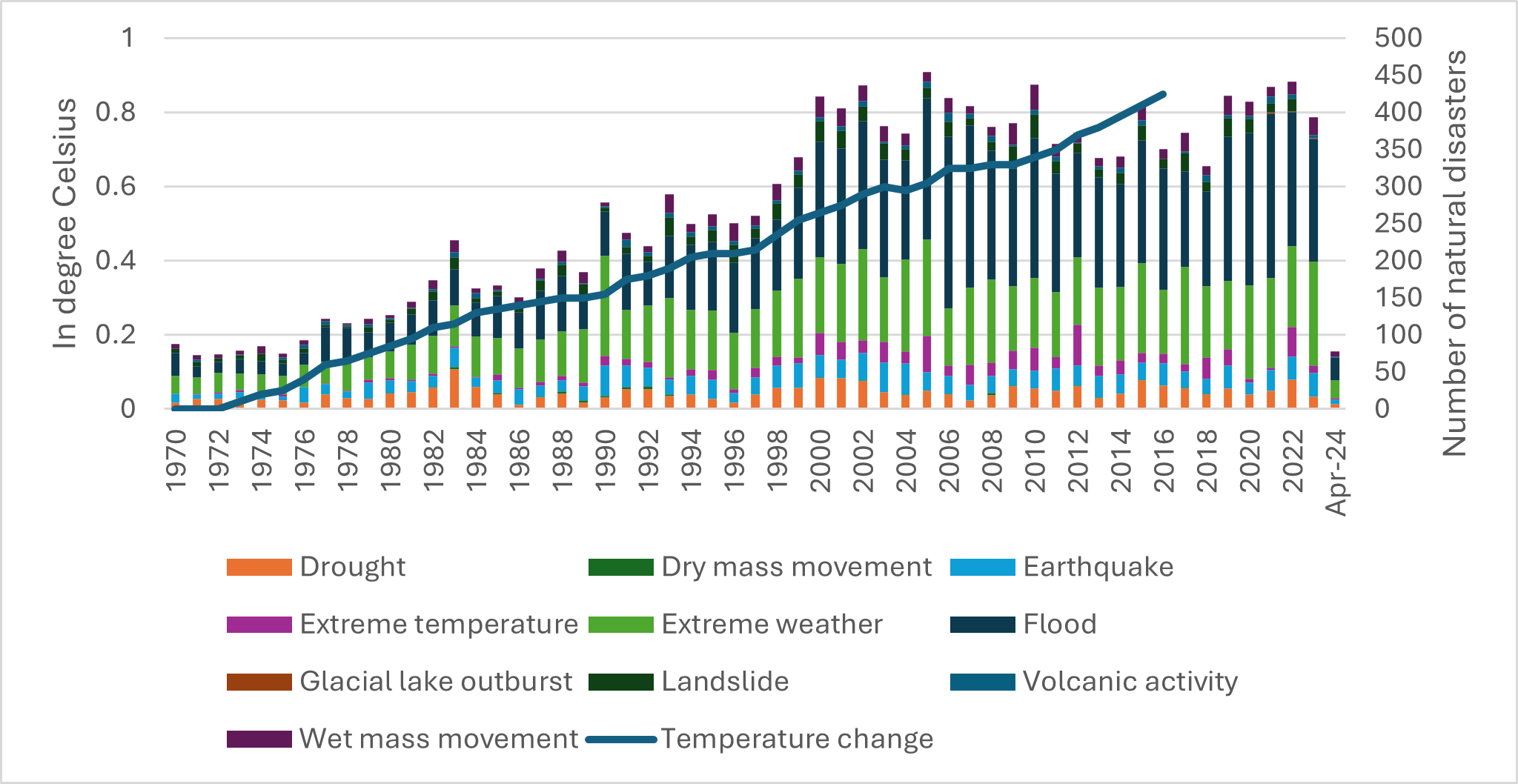

Towards the end of 2023 and year-to-date 2024, the world witnessed a series of extreme weather events, including floods in Australia and Spain, and heatwaves in the US, India and Saudi Arabia. While the total number of natural disasters stabilised in the 2000s and 2010s (see Exhibit 1), it is evident that extreme weather events such as flash floods, drought and heat waves are becoming increasingly dominant. Non-weather events, particularly earthquakes, can still drive exceptional economic losses, as illustrated by the devastating Great Hanshin Earthquake in 1995 and the Tōhoku Earthquake and Tsunami in 2011. Nonetheless, in recent decades, extreme weather and water-related events have been the major contributors to economic losses from natural disasters.

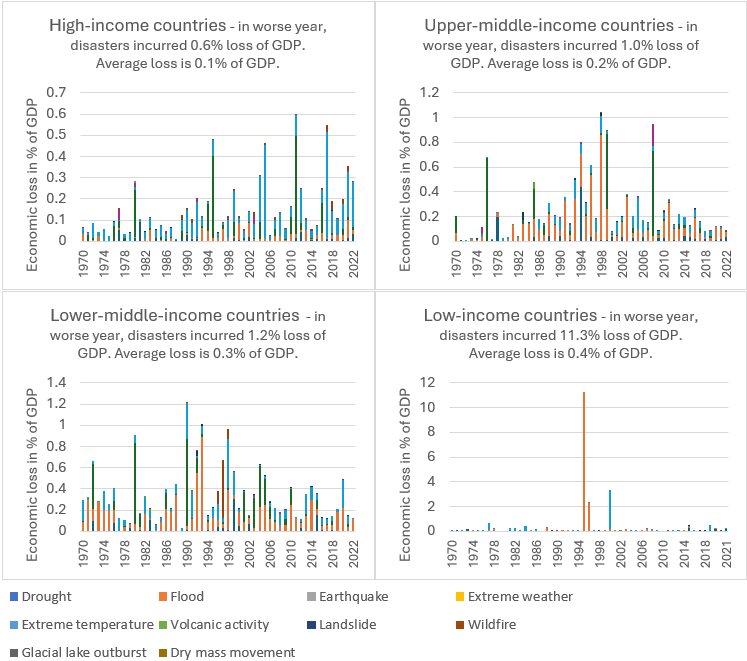

Generally, higher-income countries can afford greater investment in risk mitigation and prevention measures, supported by a robust insurance sector that offers ex-ante risk financing options. While many mega losses also occur in advanced markets, partly because of higher risk value accumulation, the overall impact on these societies is smaller. This is reflected in the lower economic losses as a percentage of GDP in higher-income markets from natural catastrophes compared to lower-income countries. For example, in a worse year, natural disasters cost high-income countries 0.6% of GDP, compared to 11.3% for low-income countries. (see Exhibit 2).

Exhibit 1: Observed average surface temperature change (base year 1970) and Number of global reported natural disasters by type since 1970.

Sources: Atlas of Sustainable Development Goals 2023, The World Bank. And Our World in Data with data source from EM-DAT, CRED / UCLouvain, 2024. Data includes disasters recorded up to April 2024.

Exhibit 2: Economic damages from disasters as a share of GDP, 1970 to 2021.

Sources: Our World in Data with data source from EM-DAT, CRED / UCLouvain, 2024 and multiple sources compiled by World Bank, 2024.

Note 1: High-income countries refer to economies with more than USD14,005 Gross National Income (GNI) per capita. Upper middle-income economies are those with a GNI per capita between USD4,516 and USD14,005; Lower middle-income between USD1,1546 and USD4,515; Low-income are with USD1,145 or less.

Note 2: Great Hanshin earthquake (Japan, 1995); hurricane Katrina (2005); Tōhoku earthquake and tsunami (Japan, 2011); hurricanes Harvey, Irma and Maria (2017)

Natural catastrophe protection gaps

Due to their more fragile economic conditions and lower preparedness and resilience to disasters, emerging markets are more vulnerable to natural catastrophes. This vulnerability is reflected in the higher economic losses as a percentage of GDP of these markets. At the same time, a larger proportion of these losses are uninsured in emerging markets compared to advanced markets, due to differences in insurance penetration. According to Aon, an insurance broker, 69% of the global economic losses in 2023 from physical damages due to natural disasters were not insured.[1] The reasons for this include both supply and demand factors, as well as increasing unmodelled losses due to climate change.

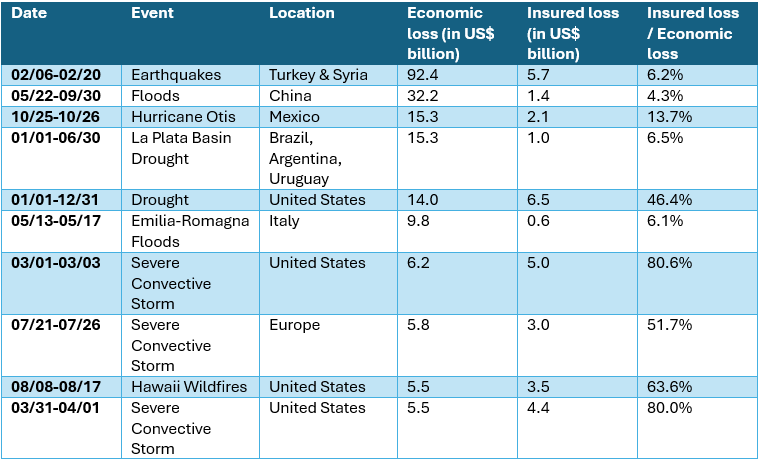

The property protection gaps in key emerging regions are typically over 90%. In the US, Oceania and Western Europe, they are typically 30-40%.[2] For example, in 2023, events causing economic losses of over USD10 billion mainly occurred in emerging markets where preparedness, resiliency and insurance penetration tend to be lower than in advanced markets (see Exhibits 3 and 4).

Exhibit 3: Top 10 global economic loss events in 2023.

Source: Aon plc.

Exhibit 4: Number of natural disasters reported globally by type with respective economic and insured losses since 2013.

Sources: Our World in Data with data source from EM-DAT, CRED / UCLouvain, 2024. Data includes disasters recorded up to April 2024. And Aon plc.

Notes: Insured loss + protection gap = economic loss. Storms include tropical cyclones, severe convective storms, and European windstorms. Extreme temperature inlkudes winter weather.

Climate change widens the property protection gap, more so in emerging markets

Climate change is resulting in more frequent and damaging extreme weather and water-related events. It is also affecting multiple economic sectors like agriculture, forestry, fishery, healthcare, energy and construction. For example, the World Health Organization (WHO) conservatively projected that climate change will lead to 250,000 additional yearly deaths by the 2030s due to diseases and coastal flooding.[3] Furthermore, food insecurity will increase significantly, eroding human health globally. Climate change also contributed to the worsening of working conditions, increasing water insecurity, rising sea level, and more premature death for individuals with pre-existing conditions.[4] Considering the many ways climate change impacts societies – such as worsening public health, reducing economic income, and disrupting trade – it has the potential to increase income disparity and social fragmentation.

Nonetheless, the negative impact of climate change on extreme weather events is expected to be most keenly felt in emerging markets. To begin with, the economic structure of many emerging or low-income countries are heavily dependent on agriculture or mineral extractions, which are highly vulnerable to climate variability. Additionally, the lack of economic diversification renders these markets vulnerable to sequential hits over time. Furthermore, emerging markets typically have less financial capacity to invest in climate resilience and adaptation measures, including infrastructure improvements, disaster preparedness, and recovery efforts. Lastly, insurance penetration is typically much lower in these markets.

According to S&P Global Ratings, if global warming is not contained well below 2°C by 2050 and in the absence of effective adaptation plans, up to 4.4% of the world's GDP could be lost annually.[5] Importantly, lower-income nations are expected to be 4.4 times more vulnerable than the developed ones, as they are disproportionately exposed to climate risks and less able to prevent permanent losses. The rating agency also estimates that water stress and extreme heat could represent around 60% of potential economic losses associated with physical climate risks by 2050 without adaptation plans. Other hazards, such as pluvial and fluvial floodings and wildfire, would contribute between 10% to 15% losses each.

In summary, alongside further global warming, the risk of extreme weather events has increased significantly. The challenge to model adequately climate change and the associated meteorological and hydrological risks means the protection gap will likely widen. It is most concerning that we will likely see the gap widen further in emerging markets, even from an already high level.

While this article covers the impact of climate change on natural catastrophes and the property protection gaps, the ramifications of global warming are much broader and more uncertain. In a subsequent article, we will explore how different economic sectors could be impacted by climate change, including the effects on various insurance business lines.

[1] Aon plc., 2024 Climate and Catastrophe Insight, 2024

[2] Deloitte Center for Financial Services, 2025 global insurance outlook: Evolving industry operating models to build the future of insurance, 2024

[3] World Health Organization, Climate Change, 2023

[4] IPCC, Sections. In: Climate Change 2023: Synthesis Report, 2023

[5] S&P Global Ratings, Lost GDP: Potential impacts of physical climate risks, 2023

with Peak Re