The demographic profile of Asian economies is diverse, encompassing a mix of Gen X, Y, and Z within the working population.

In Peak Re’s 2024 Emerging Asia Middle Class Consumer Survey[1], we interviewed a total of 7,080 consumers across six key emerging Asian markets. Our focus on middle-class consumers aged 25 to 50 resulted in a sample heavily biased towards Gen Y, or Millennials, who were 28 to 43 years old at the time of the survey. Consequently, 72% of the sample were Millennials. Gen X, aged 44 and above, comprised 14% of the sample, while the remaining 13% were Gen Z consumers, aged 25 to 27.

Gen Z represents an increasingly significant demographic group in emerging Asia. By 2025, Gen Z is expected to constitute at least a quarter of the population in the Asia-Pacific region. For example, the Gen Z population in China is estimated at 233 million, accounting for 13% of household expenditure.[2] This cohort is coming of age in a rapidly evolving economic landscape characterised by technological advancements and shifting social norms. Understanding their attitudes and behaviours is crucial for insurance practitioners aiming to tap into this burgeoning market.

Various strategies are being employed to engage the Gen Z consumer segment. Some focus on offering unique styles and personalized experiences that cater to Gen Z’s individuality. Others emphasize digital engagement and the use of social media platforms, which are pivotal for reaching Gen Z consumers. Additionally, the importance of sustainability and Diversity & Inclusion is highlighted in driving the consumption behaviours of Gen Z consumers.

Some Observations on Gen Z

Based on the findings of the survey, we have observed variations in the attitudes and risk preferences of different generations. However, it is important to note that these differences are generally small and incremental. Predictably, given that most Gen Z individuals are still at the early stages of their careers or are still in school, they have less financial wealth and are less likely to be the household breadwinners. However, this does not stop them from asserting themselves in family financial decisions or having confidence in their self-assessed financial literacy.

Focusing on the Gen Z, the youngest cohort, also known as “Zoomers”, we have identified three key observations.

1. Ambition and Insurance Awareness

The middle-class Asian Gen Z demographic is at an earlier life stage, with many currently in the lower middle-class segment. Nonetheless, they are more ambitious and self-confident compared to Millennials and Gen Y, with a strong desire to move up from middle-class status. Furthermore, when asked to self-assess their level of financial literacy, Zoomers are equally likely to consider themselves very knowledgeable or experts in finance, similar to the older and more experienced Gen Y.

When it comes to insurance awareness, Gen Z consumers are generally less informed about the different types of insurance products, both life & health and property & casualty. Despite this, cybersecurity insurance stands out as an exception, with higher awareness among Gen Z compared to Millennials and Gen X (see Figure 1). This could be due to their digital nativity and concerns about online security.

Figure 1: Awareness of different insurance products

Source: Peak Re 2024 Emerging Asia Middle-Class Survey

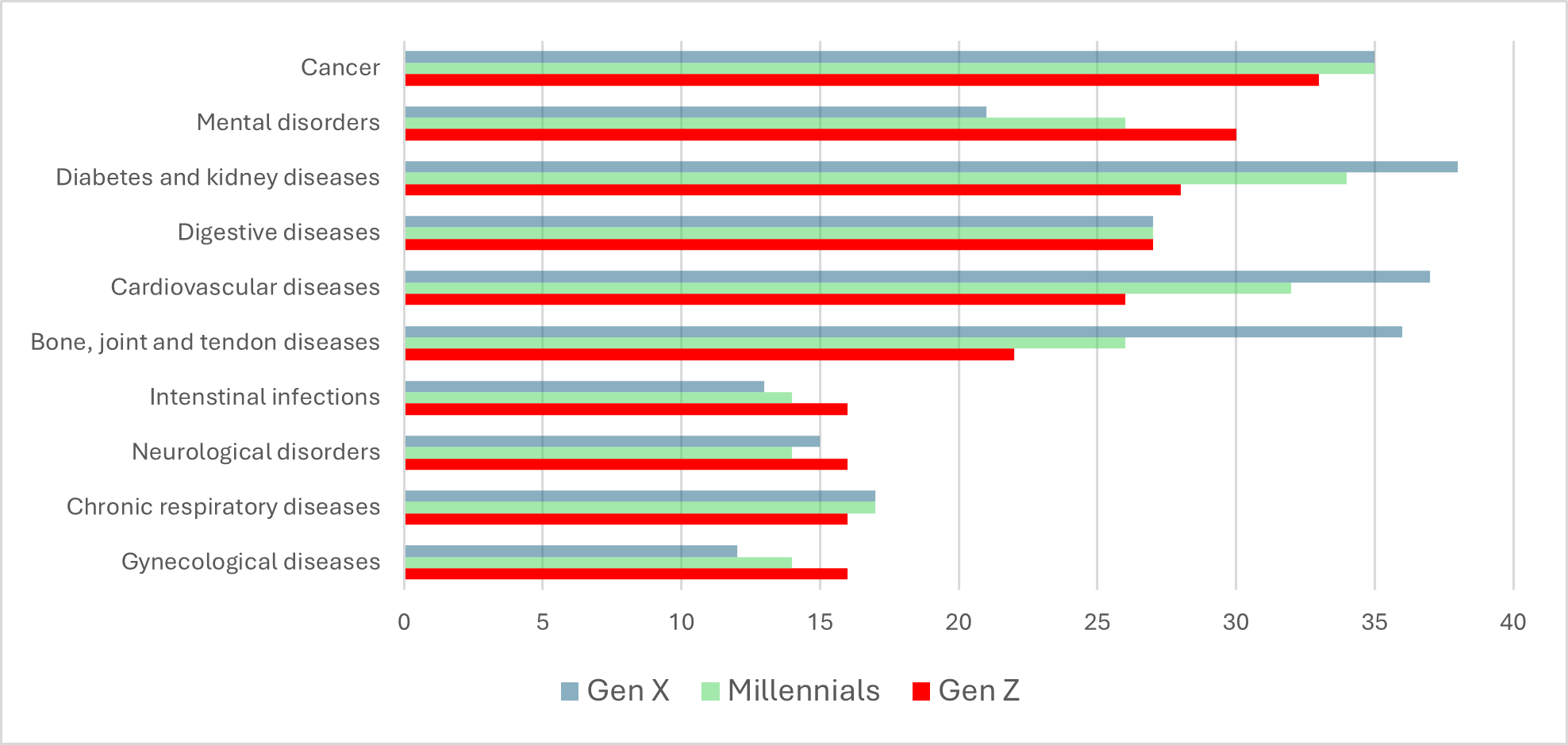

2. Health Concerns

Gen Z’s health concerns are varied, with a notable emphasis on mental health issues. While they share concerns about diseases such as cancer, diabetes, and cardiovascular diseases with older generations, mental health disorders like depression and anxiety are more prominent among their worries. This insight highlights the importance of addressing mental health care in insurance products tailored for Gen Z.

This finding is consistent with earlier research showing that Gen Z is more open about discussing mental health issues and more likely to seek help and use mental health services. They are also more inclined to purchase wellness products and services, according to a consumer survey covering China, the US, and the UK.[3] This likely reflects their familiarity with and access to information via digital platforms, which helps reduce stigma and encourage self-diagnosis.

Source: Peak Re 2024 Emerging Asia Middle-Class Survey

3. Family Responsibility and Stress

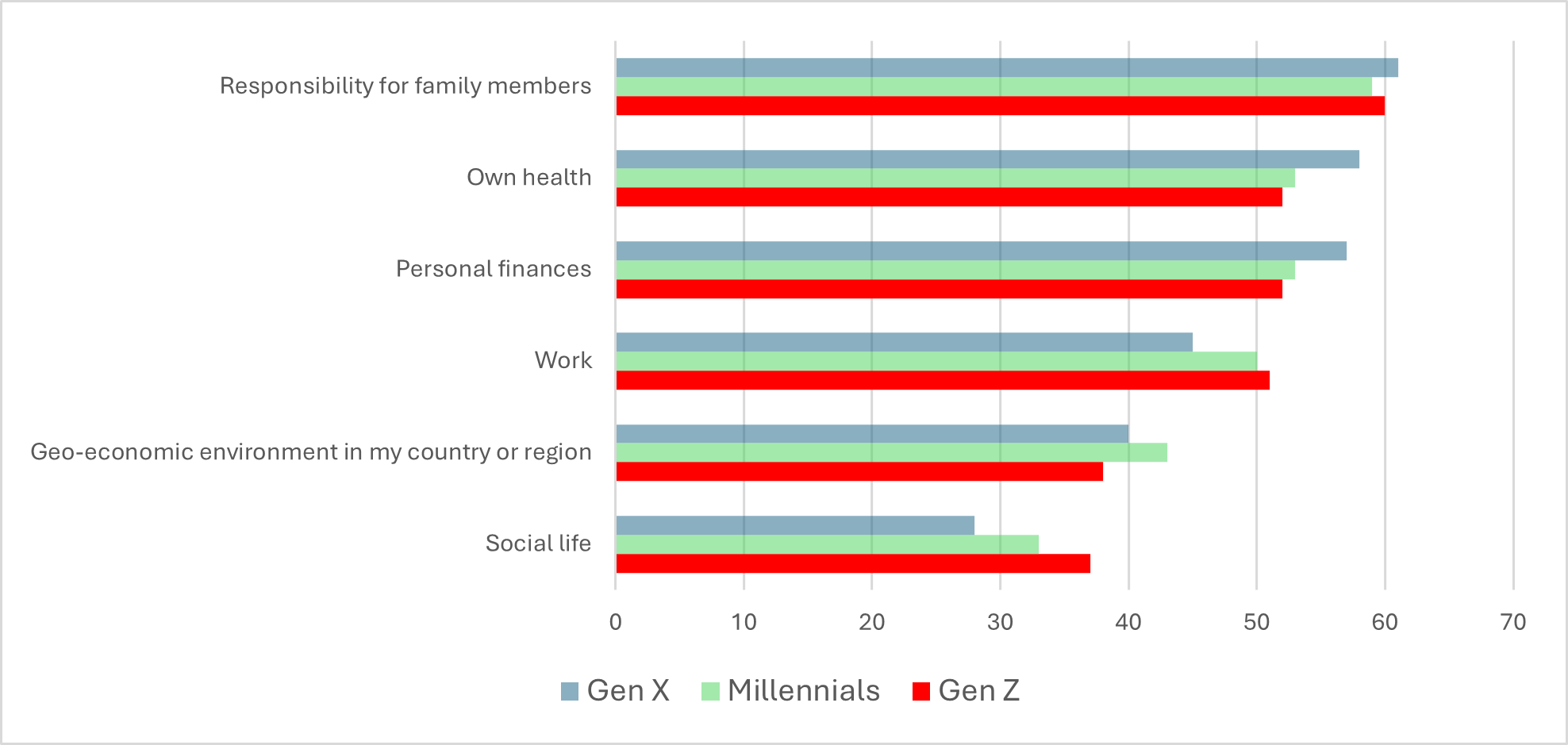

Various research has shown that Zoomers report higher levels of stress and anxiety compared to older generations. In the US, for instance, studies indicate that Gen Z has the least positive life outlook, including lower levels of emotional and social well-being.[4]

In emerging Asia, middle-class Gen Z individuals exhibit similar levels of stress as their Gen X and Gen Y peers. They are equally likely to consider themselves the main caregivers for their parents, similar to Millennials and Gen X. While this responsibility is a source of pride, it also contributes to their stress levels. Additionally, they experience significant stress from work and, in particular, social life, more than their older peers.

Figure 3: Sources of worries or stress for different generation cohorts

Source: Peak Re 2024 Emerging Asia Middle-Class Survey

Conclusion

Understanding the unique characteristics and concerns of Gen Z in emerging Asia is essential for insurance practitioners. This cohort’s ambition, health concerns, and digital awareness present both challenges and opportunities. By tailoring insurance products to meet their specific needs and preferences, the industry can better serve this growing segment and foster long-term customer relationships.

[1] See Unlocking Potential: Asia’s Middle-Class Women and Old Age Care, Peak Re

[2] Gen-Z in Asia, SIAPARTNERS, 28 September 2023.

[3] See McKinsey & Company and “Generational Differences in Approaching Mental Health”, FHEHealth.

[4] Addressing the unprecedented behavioral-health challenges facing Generation Z, Mckinsey & Company.

with Peak Re