The global reinsurance market is estimated to be worth about US$ 250 billion, with non-life reinsurance accounting for US$ 170 billion and life reinsurance making up for the remainder. Based on premiums generated by domestic reinsurers and foreign reinsurer subsidiaries, the US and Germany boast a combined global market share of about 40%. China’s share is still rather marginal at about 2%, significantly falling short of the nation’s 7% share in the world’s direct insurance premiums.

Given its B2B character, reinsurance regulatory and supervisory regimes differ greatly from those applicable to primary insurers, in particular those operating in the B2C space. The most relevant rules and regulations from a reinsurance perspective relate to crossborder trade and to the modalities of establishing a presence abroad. As reinsurers tend to cover large, complex and sometimes catastrophic risks on behalf of professional customers, it makes no sense for reinsurers to be required to calculate their solvency capital based on standard formulas applicable to more standardised and homogeneous businesses such as personal lines risks. Solvency II, for example, permits, subject to regulatory approval, the use of internal models and company-specific parameters for the purpose of regulatory capital calculations. Based on such models reinsurers are able to reflect the peculiar capital implications of their globally diversified and relatively volatile books of business. Reinsurers are also subject to comprehensive requirements from rating agencies which tend to be even more rigorous than regulatory standards.

Rules and regulations governing international market access regimes are most relevant to reinsurers. Professionally run, properly supervised and well-capitalised reinsurance companies should be able to operate in open markets worldwide in order to ensure an effective geographical diversification of risks. The latter is the core of the value proposition of reinsurance, arguably even its raison d’être.

Reinsurance can either be sold crossborder, via branches or through subsidiaries. Global reinsurers’ business models are based on the widest possible utilisation of diversification benefits. For their business models to work best – also from a policyholder perspective, they need to be able to write a large number of diversified risks in as many geographic markets as possible. The better diversified a reinsurer, the more likely it will withstand large catastrophic events and minimize its cost of capital which, in competitive markets, will be passed on to cedants and policyholders. It is therefore crucial for well-capitalised reinsurers operating in globally recognised supervisory environments to enjoy unrestricted access to global markets. The most common form of service provision in reinsurance is based on cross-border trade. For any jurisdiction to maximise the benefits from reinsurance for domestic insurers and policyholders, there should be no restrictions on or disincentives to crossborder business such as differential treatment of transactions, including the credit for reinsurance afforded to ceding companies, based merely on the reinsurer’s country of origin.

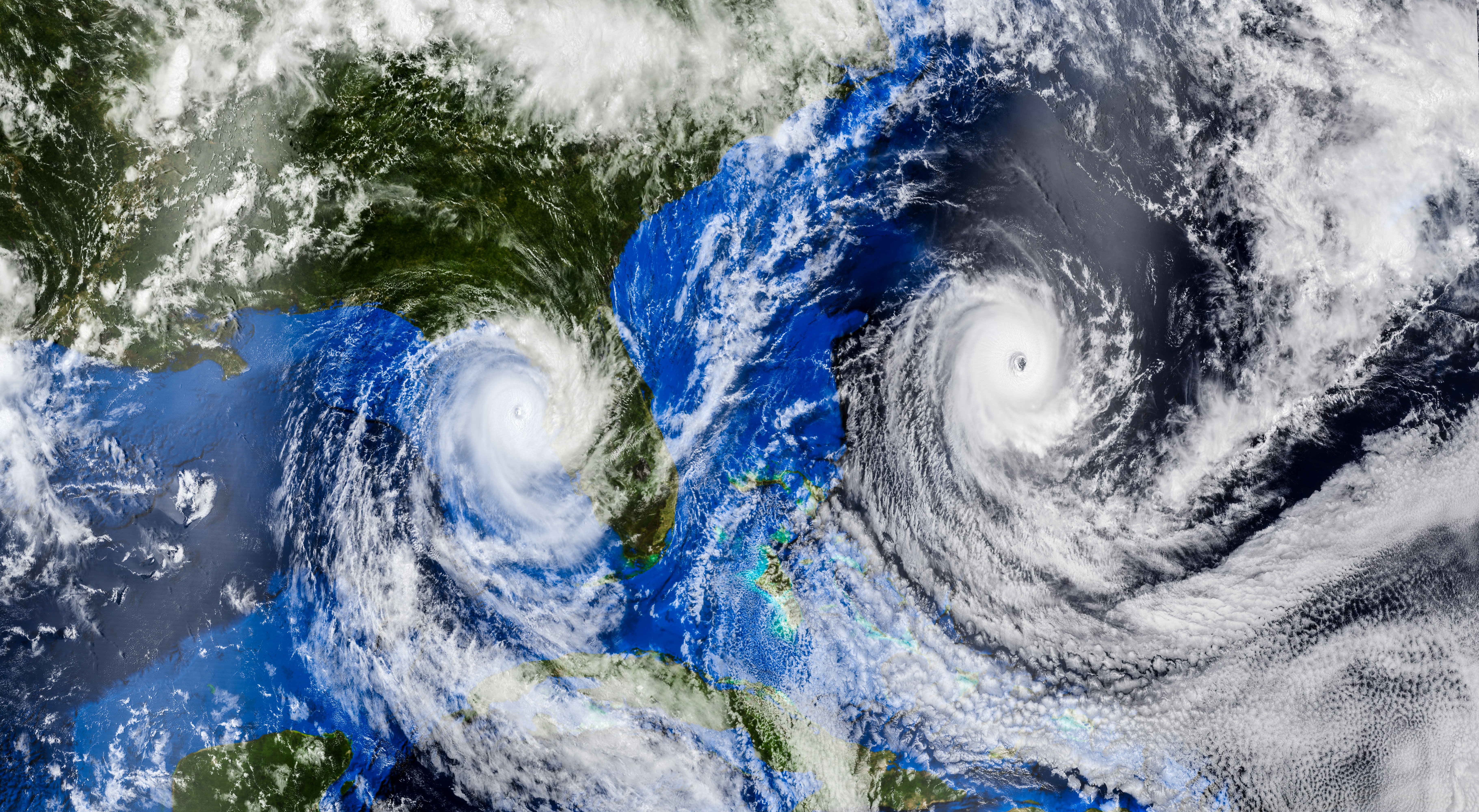

Discriminatory prudential provisions for cross-border reinsurers impair the strength of any local insurance market by hindering access to competitively priced international reinsurance capacity and essential risk management expertise. Such restrictions also compromise financial stability in the event of major catastrophes, as losses may be concentrated with domestic insurers or reinsurers rather than globally spread and distributed.

Ultimately, local taxpayers would have to foot the bill. Branches are another important mode of providing reinsurance services abroad. They play a key role for many reinsurers in accessing and servicing cedants in foreign markets. Branches are not separately incorporated legal entities. Therefore, cedants dealing with reinsurance branches can benefit from the strength of a reinsurer’s unfragmented global capital base, rather than being limited by the local capital base of a foreign reinsurance subsidiary. For the reinsurer, the branch option is clearly preferable from a global capital efficiency point of view as any fragmentation of capital creates additional cost. In competitive markets, the economic benefits arising from unfragmented reinsurer capital bases will be passed on to local cedants and, ultimately, their policyholders.

The most recent trend in some countries (e.g. China) to impose capital charges on branches translates into higher reinsurance costs. Imposing extra capital charges on branches undermines effective global diversification. It also adds to reinsurers’ cost of capital and will likely result in higher premiums for local policyholders. These charges increase the overall solvency requirements of global reinsurers, but do little to improve policyholder protection or enhance the resilience of the local insurance market. Similarly, if domestic insurers are forced or incentivised to cede more of their risks to local reinsurers (such as in Indonesia) there will be a greater concentration of risk in those particular jurisdictions. The logical consequence is an increased vulnerability of local insurers and the economy at large to catastrophic losses.

Finally, one should also bear in mind that the imposition of discriminatory requirements is likely to lead to reciprocal barriers being imposed by other jurisdictions. This impairs domestic reinsurers’ ability to expand abroad which is a key prerequisite to building an efficient and effective business model.

Having said all this, policymakers should not only look at regulatory and supervisory aspects when thinking about how to capture the benefits of global reinsurance, including the establishment of thriving domestic reinsurance markets with positive effects on labour and capital markets. No doubt, a conducive regulatory environment is a necessary condition for the emergence of a prospering local reinsurance market or even hub of international importance. Firstly, economic, legal and regulatory stability and predictability. This aspect has greatly accelerated the emergence of smaller global reinsurance hubs such as Singapore and Switzerland. Secondly, a competitive and internationally accepted tax regime, including a network of DTAs. Examples of such jurisdictions include Bermuda and Ireland. Thirdly, a state-of-the art infrastructure, in particular international air links. And, last but not least, a high quality of living. Reinsurers usually have to recruit globally and very much benefit from a location’s appeal to internationally experienced and multilingual talent.

If all these regulatory and non-regulatory ingredients are in place, an economy can reap significant benefits associated with strong and open reinsurance markets. First and foremost, reinsurance allows insurers to reduce their underwriting risk across a broad range of non-life and life business classes. It thereby enables insurers to strengthen their solvency and expand their capacity to absorb additional and new types of commercial or retail risk, both catastrophic and non-catastrophic.

Reinsurance also helps insurers to reduce earnings volatility which is set to have a positive effect on their cost of capital. In competitive markets, policyholders are the ultimate beneficiaries, in the form of lower prices.

In addition, from a macro-economic point of view, reinsurance is among the global sectors generating the highest added value per employee. For example, in Switzerland, the world’s 4th largest reinsurance market (based on S&P’s definition mentioned above), less than 5’000 reinsurance employees generate a total economic added value of about US$ 6 billion. This translates into an added value per capita of more than US$ 1 million. Attracting such jobs would obviously be a major boon to any economy.

In summary, rapid economic development associated with a massive concentration of insurable values, huge risk exposures as a result of climate change and increasingly globalised and interconnected production and distribution chains add to the importance and benefits of efficient international risk pooling through unrestricted trade in reinsurance services. Countries should not have recourse to myopic protectionist measures but rather focus on capturing the potential of thriving reinsurance markets for the development of their national insurance industries and economies at large.

with Peak Re