Although environmental risks, including extreme weather events, continue to rank among the most significant threats to societal stability, it was nonetheless observed that private sector organisations appear to be placing less emphasis on climate-related issues in 2025 compared to earlier years. This subtle shift is probably due to senior management of the private sector being preoccupied with intensifying geopolitical instability and evolving macroeconomic dislocations, which have diverted attention from sustainability agendas. Meanwhile, there is a discernible increase in attention, particularly among institutional investors, on connecting sustainability with value creation. This evolving focus reflects a broader recognition that environmental stewardship and long-term financial performance are not mutually exclusive. Such alignment could help add momentum to the quest for sustainable insurance solutions. Insurers can leverage their expertise in risks insurability to drive value creation, in partnership with their clients.

Macroeconomic and geopolitical risks overshadowed climate concerns

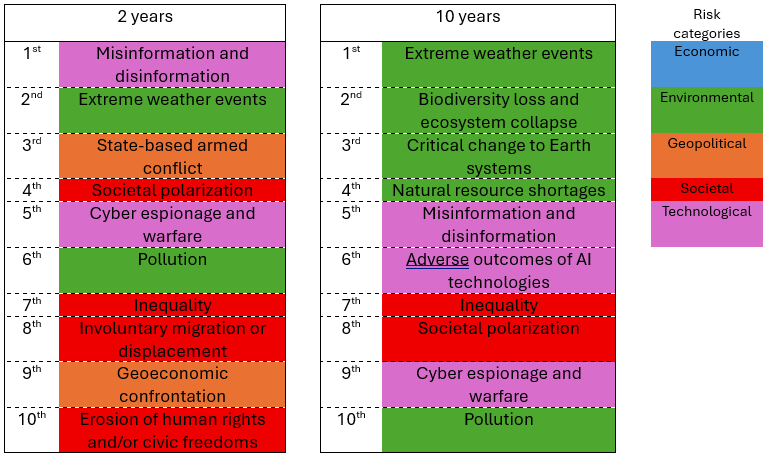

Through 2024 and into 2025, the attention of the executives from the private sector has been heavily concentrated on the prolonged macroeconomic uncertainty and heightened geopolitical tension. The fast proliferation of AI and agentic models has further compounded concerns about the spread of misinformation and disinformation. As revealed in the latest risk survey conducted by the World Economic Forum, environmental risks remain critically important to societies, in both the short- and the long-term (see Figure 1). Yet, among private sector respondents, it is worthy to note that concern on “extreme weather events” has been surpassed by “social polarisation” and “state-based armed conflict” over the short term (two years horizon). Similarly, for government stakeholders, concern on “misinformation and disinformation” has replaced “extreme weather events” as the most pressing issue over the short-term horizon.

This trend is corroborated by other industry surveys. For instance, in the first quarter of 2025, climate change was ranked 9th among the top 10 risk priorities in a survey conducted by the Association of Chartered Certified Accountants (ACCA) and the Institute of Management Accountant (IMA).[1] This is one rank down from the same survey conducted a quarter earlier, underpinning a broader deprioritisation of climate-related risks in the face of more pressing socio-political and economic challenges.[2]

Figure 1: Global risks ranked by severity over the short and long term

Source: World Economic Forum, The Global Risks Report 2025

While it is understandable that management teams of private sector organisations remain preoccupied with short-term challenges, climate change remains a critical long-term issue that warrants close attention. Recent research underscores the strategic importance of sustainability, particularly in light of findings that show investors disproportionately reward organisations with clear business cases linking sustainability initiatives to value creation.[3]

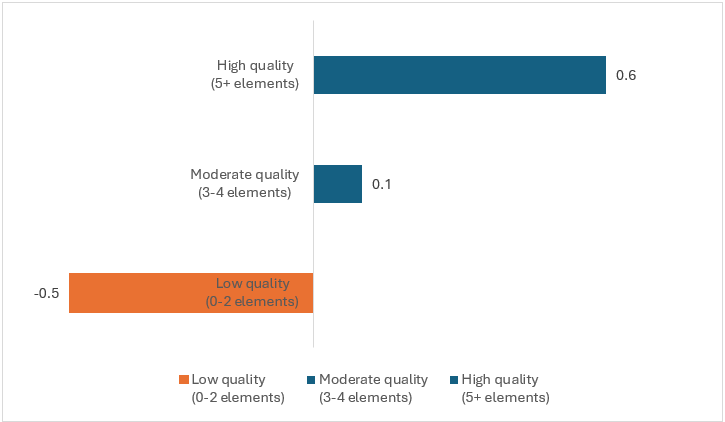

According to analysis by the Boston Consulting Group (BCG), high-quality sustainability-related announcements outperformed low-quality ones by an average of 1.1 percentage points in relative total shareholder return (rTSR) three days following an announcement (see Figure 2). This figure shows the tangible financial benefits of well-articulated sustainability initiatives. At the same time, while the number of such announcements has increased by more than seven-folds between 2022 and 2015, 82% of announcements still fall short of best practice in 2022. This highlights that while awareness and activity are increasing, the quality and strategic coherence of such initiatives (and announcements) remain inconsistent.

Figure 2: Effect of including business case elements in sustainability-related announcement, average three-days rTSR (%)

Notes:

(a) The measurement is the change in company’s shareholder return relative to the market three days following the announcement for the period of January 2015 to December 2022. Sectors included in the analysis are aerospace / defense, apparel, automotive, banking, chemicals, construction, consumer goods, energy, machinery and electrical equipment, metals, mining, pharmaceuticals, retails, transportation, and utilities.

(b) Quality of the announcement is measured by the number of elements met of the seven elements considered material for effective business case: (1) material to the sector, (2) connected to the core strategy, (3) includes tangible goals, (4) third-party verified, (5) clear in funding, (6) material to the company, and (7) linked to value creation.

Source: Boston Consulting Group, Six ways to link sustainability and value creation, 2025

Integrating sustainability into business models for value creation

Cash flow is a fundamental component of corporate valuation. Typically, preserving and extending the duration of future cash flow, reducing volatility as well as increasing the level of free cash flow could raise a company’s valuation. Sustainability initiatives could be constructed to improve business operations and strengthen future cash flow in order to create value. By its very nature, insurance plays a critical role in preserving the capital of insured entities and reducing their result volatility. However, insurance companies could complement their value proposition by offering sustainable insurance products and solutions that actively support value creation. These offerings may include coverage tailored to climate-related risks, incentives for risk-reducing behaviours, and partnerships that promote climate adaptation and resilience.

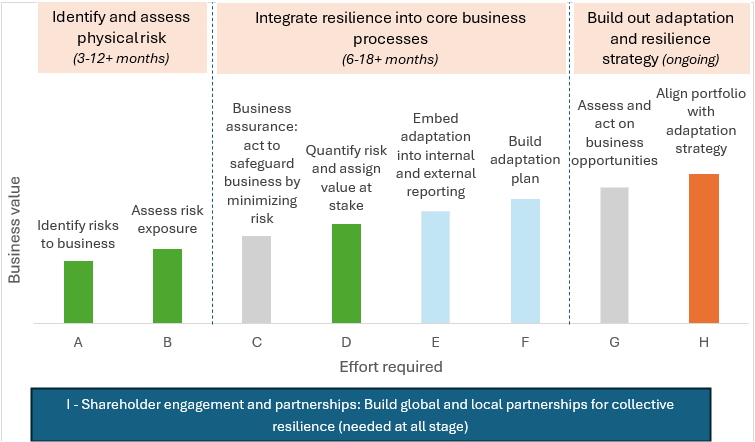

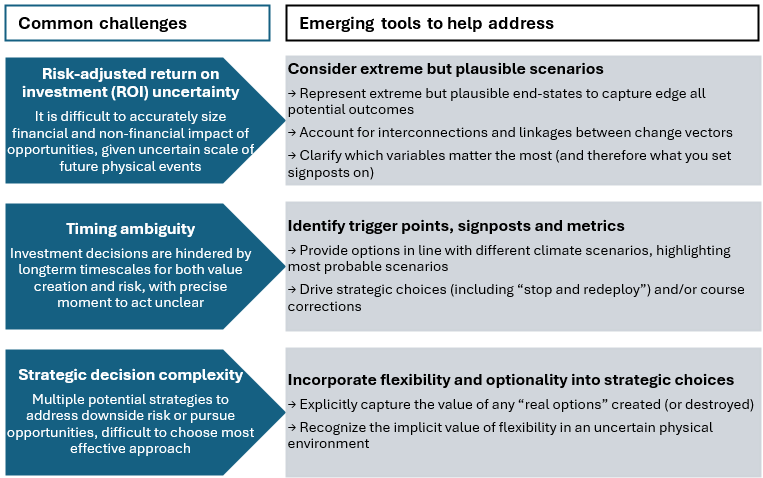

Framing a company’s sustainability and climate adaptation strategy is inherently complex. Acknowledging these complexities, the World Business Council of Sustainable Development has several suggestions including setting plausible scenarios, identifying trigger points and establishing relevant metrics to guide effective actions (see Figures 3 and 4). Insurers are already supporting their clients in identifying and assessing climate risks. They can additionally offer their expertise to corporates by screening the portfolio and location for physical climate risks and quantifying the financial impacts. Insurance companies can do so by leveraging their database of historical insurance claims data and evaluating the insurability of those risks (e.g. combining engineering insight for risk adaptation and catastrophe models).

Figure 3: Key actions to build an adaptation strategy

Notes: Green bars mean the likely lead or sponsor is the Chief Risk Officer. Grey bars stand for Chief Operating Officer or Head of Business Unit as the likely lead or sponsor. Blue and Orange bars respectively refer to Chief Financial Officer and Chief Executive Officer to be the likely lead or sponsor.

Source: World Business Council of Sustainable Development, Bain & Company, and Jupiter Intelligence, Business Leaders Guide to Climate Adaptation and Resilience, 2024

Figure 4: Common challenges and suggestions in building business case for adaptation

Source: World Business Council of Sustainable Development, Bain & Company, and Jupiter Intelligence, Business Leaders Guide to Climate Adaptation and Resilience, 2024

There is a clear mutual benefit for insurers and their clients in aligning their climate adaptation objectives. On one hand, companies that proactively implement conventional risk mitigation and climate adaptation measures to shield their assets from climate risks can reduce their overall risk exposure. This, in turn, translates into improved insurability of risks or in other words, higher-quality risks for insurers. So far, insurers are viewed as providers of financial safety nets in the event of unexpected losses, rather than as strategic partners in value creation. This perception leads to a lack of communication and alignment between insured entities and their insurers. As a result, the limitations of insurance become more apparent when certain risks grow increasingly difficult to insure, as manifested in higher insurance premiums, more restrictive terms and an increase in exclusions.

Insurance for value creation with a business adaptation plan

To address the challenge of insurability, a change in mindset is needed. This could involve expanding the traditional value proposition of insurance from being solely a financial safety net provider to becoming a value-creation partner. To achieve this, insurers may encourage their clients to share more information about their planned/ implemented adaptation initiatives. A compelling message might be: “A climate adaptation plan that integrates sustainable practices can help mitigate the adverse impacts of climate-related events and enable more favourable insurance premiums and terms.” The insurance premiums saved can be reinvested into further resilience-building measures, thus generating a virtuous cycle of value generation.

A two-pronged approach is needed. On one hand, companies should demonstrate tangible efforts to enhance the risk profile of their assets by reducing vulnerability. This can be achieved through infrastructure upgrades, improved operational protocols, or integrating climate scenarios in strategic planning. At the same time, such work would need to be communicated effectively with their insurers through structured data sharing and ongoing dialogue.[4] As much as possible, companies should also try to demonstrate and quantify the resilience benefits of their adaptation measures.

A recent example was the cooperation between AXA Hong Kong and Macau (AXA), Marsh, and Link Asset Management (Link, a real estate investor and manager in APAC) whereby by assessing climate risk and making targeted properties more resilient, Link achieved an impressive 11.7% reduction in property insurance premiums in 2025 compared to 2024. This is a significant reduction compared to the industry’s average premium decrease of around 3%. Link also managed to negotiate an additional 7.5% premium reduction tied to its loss ratio. The premium saved creates a financial incentive to invest in long-term climate preparedness.[5]

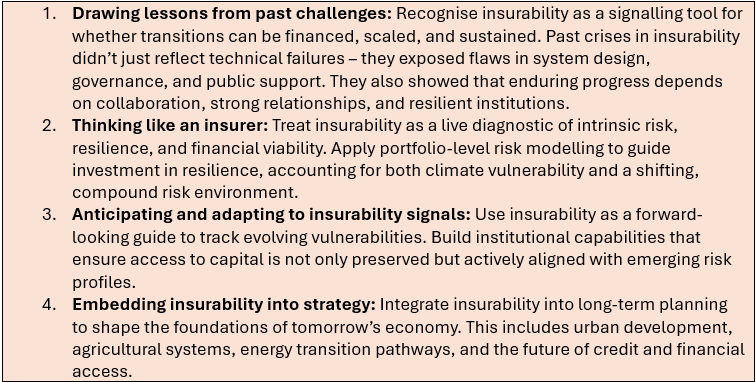

In this partnership between insurers and corporates, it is important to ensure all parties understand the following key dimensions of insurability:

Source: Howden Climate Risk & Resilience, The insurability imperative, 2025

Conclusion

Given the increasing uncertainty of losses from climate change, it is imperative that companies should better understand their exposure and resilience to climate events. This will not only help to meet the growing expectations of investors and regulators but also unlocks opportunities for value creation through adopting resilience-enhancing solutions. An effective adaption plan prevents losses and allows operations to continue uninterrupted. Meanwhile, insurers should maintain effective dialogue with their clients to frame and implement adaptation plans. Such partnership can enhance the insurability of risks which is a win-win situation for both parties. In essence, insurers need to emphasize to their clients that they should no longer view spending in climate mitigation and adaptation as an expense, but as a strategic investment that can create value through strengthening the company’s operational resilience. It also enhances the company’s appeal to investors.

(Previously, we shared some findings on the role insurers in making climate-related projects more bankable (see “Building climate resilience: The role of insurance”). This article builds on that foundation by emphasising the role of insurers in supporting value creation for their clients, particularly the assets owners.)

[1] ACCA and IMA, Global Economic Conditions Surveys Report: Q1, 2025, 2025

[2] ACCA and IMA, Global Economic Conditions Surveys Report: Q4, 2024, 2025

[3] Boston Consulting Group, Six ways to link sustainability and value creation, 2025

[4] Howden Climate Risk & Resilience, The insurability imperative, 2025

[5] AXA Hong Kong & Macau, Sustainability-Linked Insurance: Innovating to Inspire Investment in Climate Resilience, 2025

Disclaimer

Peak Re provides the information contained in this document for general information purposes only. No representation or guarantee is made as to the accuracy, completeness, reasonableness or suitability of this information or any other linked information presented, referenced or implied. All critical information should be independently verified and Peak Re accepts no responsibility or liability for any loss arising or which may arise from reliance on the information provided. All information and/or data contained in this document is provided as of the date of this document and is subject to change without notice. Neither Peak Re nor any of its affiliates accepts any responsibility or liability for any loss caused or occasioned to any person acting or refraining from acting on the basis of any statement, fact, text, graphic, figure or expression of belief contained in this document or communication.

All rights reserved. The information contained in this document is for your information only and no part of this document may be reproduced, stored or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Peak Re. Any other information relating to this document, whether verbal, written or in any other form, given by Peak Re either before or after your receipt of this document shall be provided on the same basis as set out in this disclaimer. This document is not intended to constitute advice or recommendation, and should not be relied upon or treated as a substitute for advice or recommendation appropriate to any particular circumstances.

© 2025 Peak Reinsurance Company Limited

with Peak Re